Understanding the DXY: A Key Indicator for Currency Markets

Table of Contents

- US Dollar Index News: DXY Stumbles Amid Lower Treasury Yields | FXEmpire

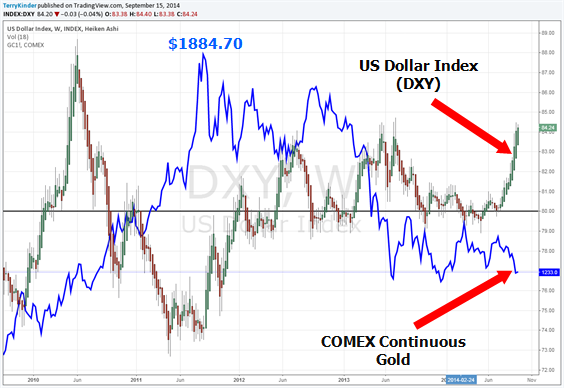

- US Dollar Index (DXY) and Gold - Bullion.Directory

- DXY — U.S. Dollar Index Chart — TradingView — India

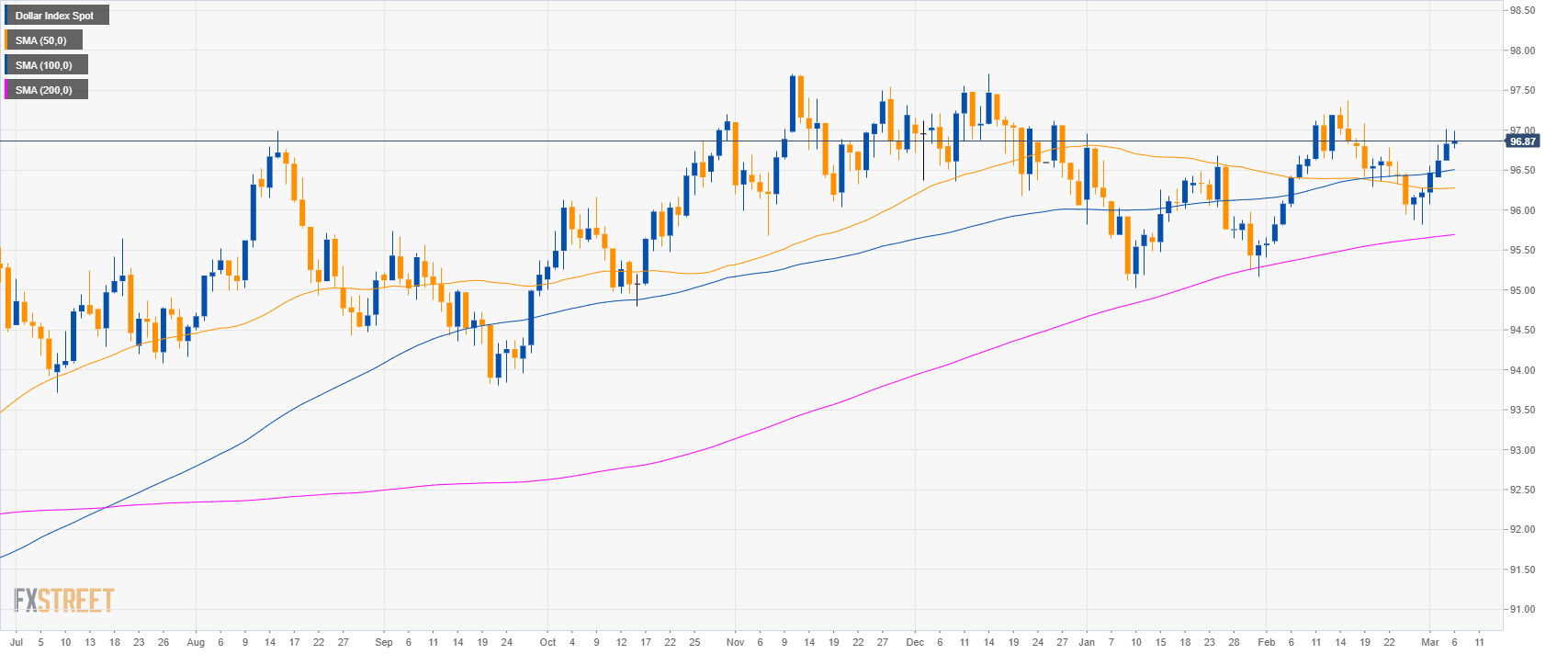

- US Dollar Index Price Analysis: DXY nearing two-month's highs, eyeing ...

- DXY — U.S. Dollar Index Chart — TradingView — India

- US Dollar Index Technical Analysis: DXY taking a breather at the 97.00 ...

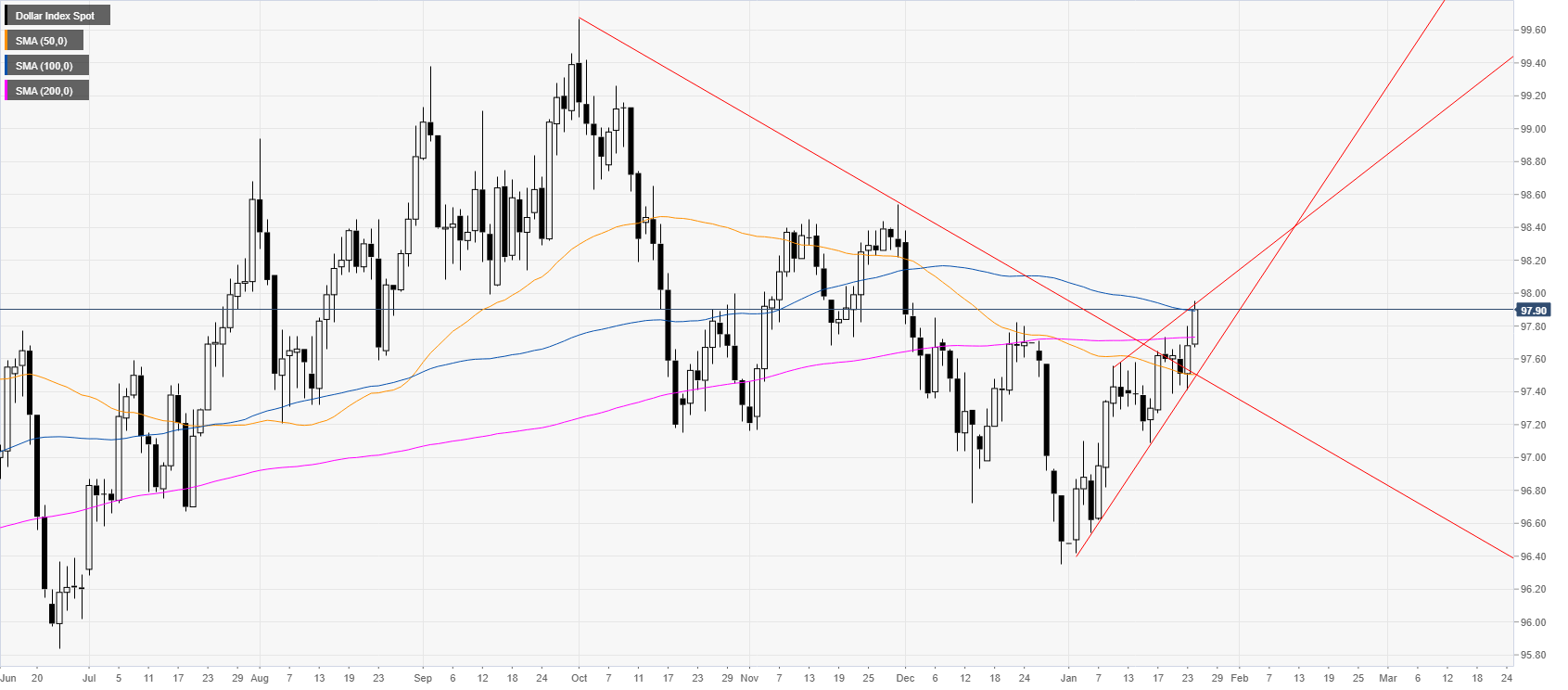

- DXY forecast as the US dollar index pulls back

- Dollar Index Chart - DXY Quote — TradingView

- US Dollar Index: DXY Recoils Ahead of Retail Sales, PPI Data

- Dxytothemoon — TradingView

What is the DXY?

How is the DXY Calculated?

Why is the DXY Important?

The DXY is an important indicator for currency markets because it provides a benchmark for the value of the U.S. dollar. A strong DXY indicates a strong U.S. dollar, while a weak DXY indicates a weak U.S. dollar. This can have significant implications for investors, traders, and policymakers, as a strong or weak dollar can affect the value of investments, trade relationships, and economic growth.

How to Stay Up-to-Date with DXY News and Quotes

For investors and traders who want to stay up-to-date with the latest DXY news and quotes, CNBC is a valuable resource. CNBC provides real-time coverage of the DXY, including news, analysis, and quotes. The network's website and mobile app also offer a range of tools and resources, including interactive charts, historical data, and expert commentary.In conclusion, the DXY is a key indicator for currency markets, providing a benchmark for the value of the U.S. dollar against a basket of six major foreign currencies. Understanding the DXY and how it is calculated is essential for investors, traders, and policymakers who want to stay informed about currency markets. By following the DXY on CNBC, individuals can stay up-to-date with the latest news and quotes, and make informed decisions about their investments and trade relationships.

Whether you are a seasoned investor or just starting to learn about currency markets, the DXY is an important indicator to watch. With its wide coverage and real-time updates, CNBC is the perfect resource for anyone who wants to stay informed about the DXY and its impact on the global economy.

Note: This article is for general information purposes only and should not be considered as investment advice. Always consult with a financial advisor before making any investment decisions.